Invest in our community housing revolution

Help us buy, refurbish and let community-led homes in the East Marsh of Grimsby

Why are we creating homes?

Everyone deserves a comfortable, affordable home with a landlord they know and trust. That’s why we’re bringing empty houses back into use - to meet the growing demand for high quality homes. By providing accommodation that allows people to flourish, we can make an enormous impact on the future of our entire community. Take a look at our share offer prospectus for more details.

Capital is at risk and returns are not guaranteed.

Read our share offer document to find out more.

We’ve already started – now we want to go further!

Our plans

Our area

Grimsby’s East Marsh is one of the most deprived wards in England, with high poverty rates, low levels of education and employment, and an average life expectancy ten years less than neighbouring areas..

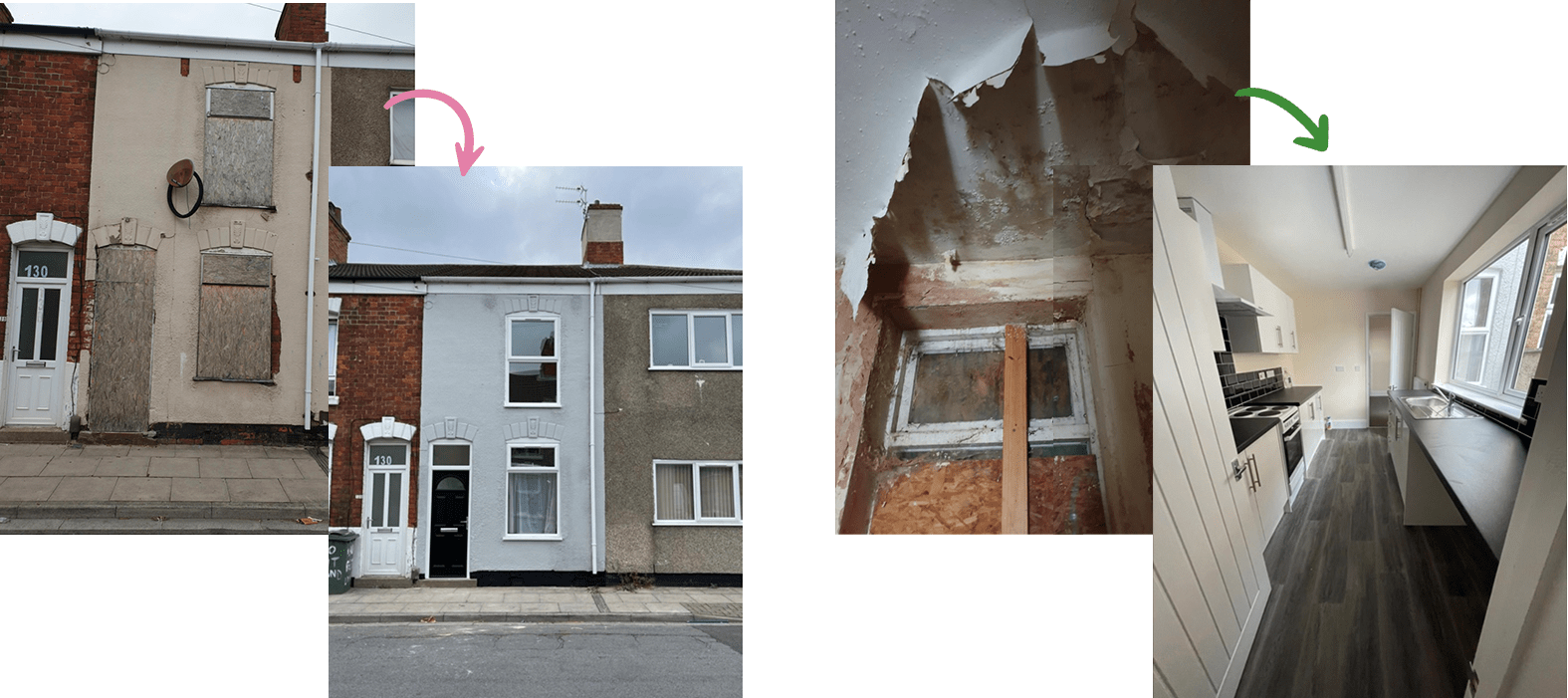

Our progress

So far, we’ve taken three houses on the East Marsh under community ownership. Our properties on Rutland Street have been refurbished to the highest standard and kitted out with modern furnishings. We’re striving to be the best community landlords we can, delivering a caring, attentive service for our tenants and giving families a truly affordable home.

Our target

We’re aiming to raise £500,000 to get us another ten houses - the next step towards our long term vision of 100 houses for 100 years. With your investment, we can give dozens of families on the East Marsh an ethical community landlord who values them for their humanity rather than their rent money.

Our belief

The transformative effects on the local economy would be vast. As we grow our housing stock, we’ll keep providing the best example of how things can be done. And with these renovated properties added to Grimsby’s housing market, standards would be raised across the town and challenge other landlords to do better. As we like to say, a rising tide lifts all boats.

For more information about our plans, please read our share offer document.

Our timeline

- November 2017 – East Marsh United founded

- February 2020 – East Marsh Community formed

- May 2020 – first house acquired on Rutland Street

- October 2020 – refurbishment complete and first tenants moved in

- December 2020 – second house refurbished

- October 2021 – third house refurbished

- March 2022 – community share offer launched

- September 2024 – aiming to refurbish tenth house

- December 2030 – hoping to have acquired 100 houses

See what we’re doing

Help us

Thank you to all who invested. Our share offer is now closed.

More information

Other bits and pieces you might need to know

Who can invest?

Individuals over the age of 18, charities and other organisations may invest in this offer.

What type of shares am I buying?

These are ‘withdrawable’ shares that cannot be sold, traded, or transferred, unlike the ‘transferable’ shares typical of a limited company, and only East Marsh Community Limited can repay them at the same value at which they were invested.

What is a community benefit society?

A community benefit society is run primarily for the benefit of the community at large, rather than just for members of the society. This means that it must have an overarching community purpose that reaches beyond its membership. An applicant enterprise must also have a special reason for being a community benefit society rather than a company, such as wanting to have democratic decision-making built into its structure. Although a community benefit society has the power to pay interest on members’ share capital, it cannot distribute surpluses to members in the form of dividends.

How much can I invest?

We are offering £1 shares with a minimum investment of £250 and maximum investment of 10% of the final issued share capital under this share offer (i.e., £50,000 if the target raise of £500k is achieved). Organisations can invest up to £100,000. The maximum investment includes any existing investment you may hold in East Marsh Community Limited.

What return can I expect on my investment?

East Marsh Community currently offers a target financial return of 4.00% per annum on your investment from 1 November 2023, together with the scope to cash-in (withdraw) your shares after the qualifying period. The interest rate is paid yearly at the discretion of the Board dependent on the financial performance of the business.

However, you should be aware that, unlike companies, there are legal limits to financial returns / interest payments on shares in co-operative and community benefit societies, based on the principle that interest should be no more than is sufficient to attract and retain the investment. Also, unlike company shares, community shares cannot go up in value, but they can go down, meaning that you could lose some or all of the money you invest.

Unlike company shares co-operative and community benefit society shares cannot go up in value, but they can go down meaning that you could lose some or all of the money you invest.

Is my investment safe?

You can be sure that your funds will make a positive difference to local communities but there is no guarantee of receiving a financial return on your investment. Investors may receive back less than their original investment and may not get it back at all. Please do not invest funds that you cannot afford to lose. You can read more about the risks of investing in the ‘Key risks’ section of the share offer document.

What are my voting rights as a shareholder?

Shareholders have only one vote, regardless of the size of their shareholding, so the society is democratic.

Can I withdraw my shares?

Whilst individual requests to withdraw will be at the discretion of the Board, EMC intends to honour share capital withdrawal requests where it can, subject to the initial minimum 24 month lock-in period and a cap on total withdrawals of 5% of the outstanding and issued share capital in any financial year. For further details on how withdrawal will work, please see the ‘Important information’ section of the community share offer document.

Where can I find more information?

We strongly encourage all potential investors to read up fully on our plans to make sure this investment is right for you.

In particular we draw your attention to the following:

- Further details are available on the Ethex website

- Our share offer document contains details of our plans including an evaluation of the risks

- Financial statements for East Marsh Community are available here: 2020 accounts 2021 accounts

- The East Marsh Community registration and rules can be downloaded here